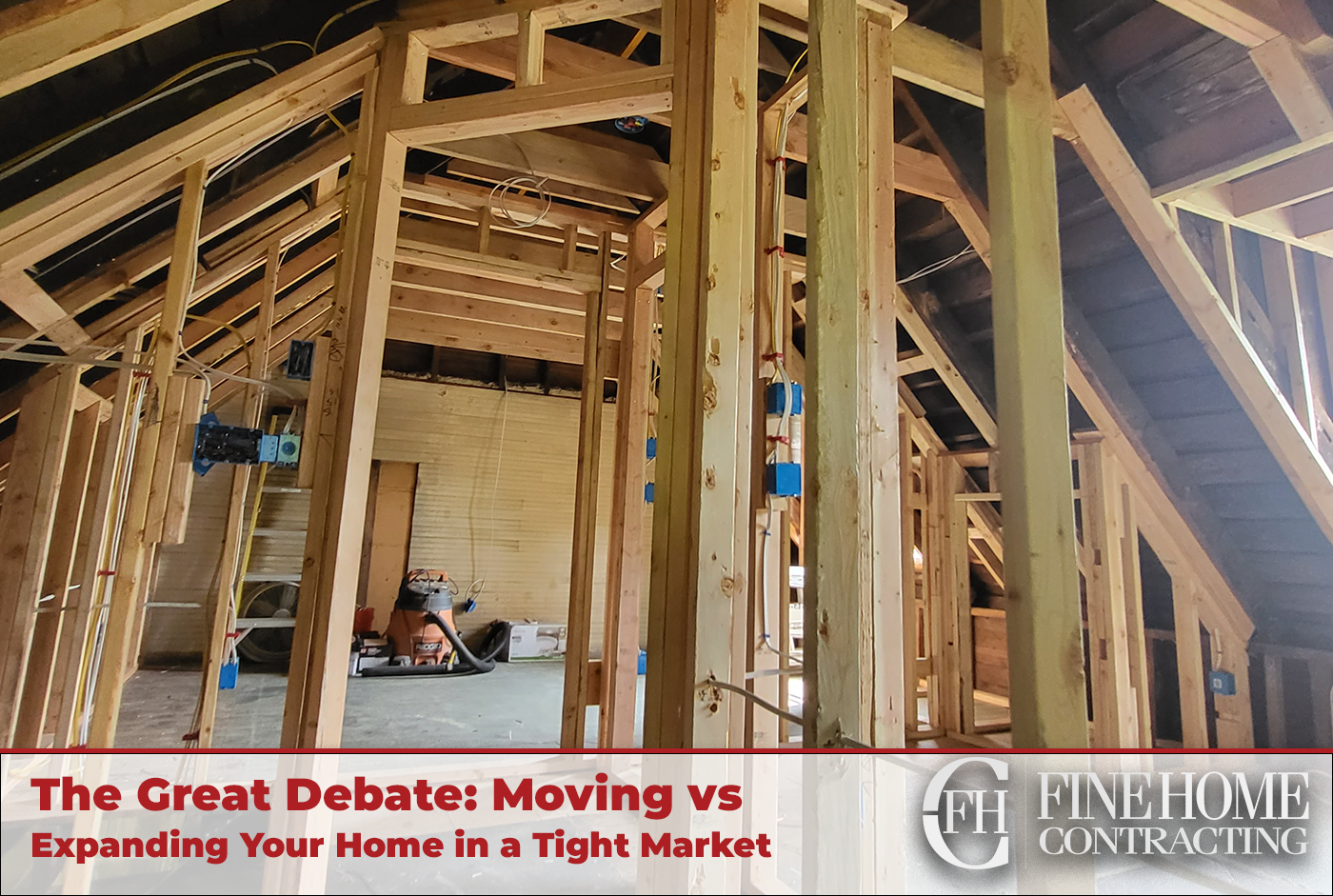

One of the largest wish-list items in any remodel is usually the same: Adding more usable, functional space to the home. Whether spurred by a growing family, changing lifestyles, or simply a desire for more comfort, expanding your existing home is sometimes the only option before moving into another property or sizing up. For those looking to remain in their home, but add in the extra space they need to be comfortable, there are three main options: A home addition, finishing a basement, or finishing an attic.

These spaces tend to be left unfinished at the time of construction for the homeowner to later remodel as they see fit, and oftentimes finishing projects add a larger amount of space at a lower cost than a complete addition. Likewise, if you’re looking for an additional primary suite, an accessory living area, or space for a home office or workspace, you might find that an attic or basement conversion doesn’t quite match your needs.

In this blog, we’ll take a quick look at each of the most popular of these space-adding home improvement projects: Informed homeowners make better decisions, which lead to better remodels, and we want to give you all the information you need to make the correct choices from day one.

Understanding the Scope:

Considering Cost Factors:

Cost is a significant consideration for homeowners contemplating space expansion. Home additions are generally more expensive due to the need for structural modifications and the addition of new construction elements. In contrast, attic and basement renovations leverage existing structures, leading to lower overall costs.

Moreover, the cost-effectiveness of renovations is particularly attractive in a housing market influenced by economic factors such as interest rates and property values. In times of low-interest rates, homeowners may find financing more accessible, potentially making home additions more feasible despite the higher upfront costs.

The Role of Renovation Loans:

For many homeowners, renovation loans like the FHA 203(k) can be instrumental in financing home improvement projects. These loans offer a single, long-term, fixed- or adjustable-rate mortgage that covers both the acquisition and rehabilitation of a property. They provide an avenue for homeowners to finance renovations without depleting their savings or taking out additional high-interest loans.

However, it’s crucial to note that the availability and terms of renovation loans are influenced by the borrower’s creditworthiness, the appraised value of the property, and the scope of the planned renovations. While these loans can make home additions and renovations more financially accessible, they should be approached with careful consideration of the long-term financial implications.

Navigating the Housing Industry:

The decision between home additions and attic/basement renovations is also influenced by the overall state of the housing industry. In a seller’s market where demand exceeds supply, adding square footage to a home can significantly enhance its marketability. On the flip side, in a buyer’s market where housing inventory is abundant, the return on investment for home additions may not be as pronounced.

Additionally, the decision to expand or renovate is tied to individual preferences and lifestyle needs. For some, the allure of a brand-new home with the latest features may outweigh the benefits of renovating an existing space. However, for those who value the character and charm of older homes, renovations may be a more appealing option.

In the ongoing debate between home additions and attic/basement renovations, there is no one-size-fits-all answer. The choice depends on a myriad of factors, including budget constraints, lifestyle preferences, and the current dynamics of the housing market. Homeowners must carefully weigh the pros and cons of each option, considering not only the immediate benefits but also the long-term impact on their home’s value and their financial well-being.

As the housing industry continues to evolve, with interest rates fluctuating and renovation loan options becoming more diverse, the decision-making process becomes increasingly complex. Ultimately, the key is to strike a balance between meeting immediate needs and making sound, financially informed decisions that contribute to the long-term value and comfort of the home.