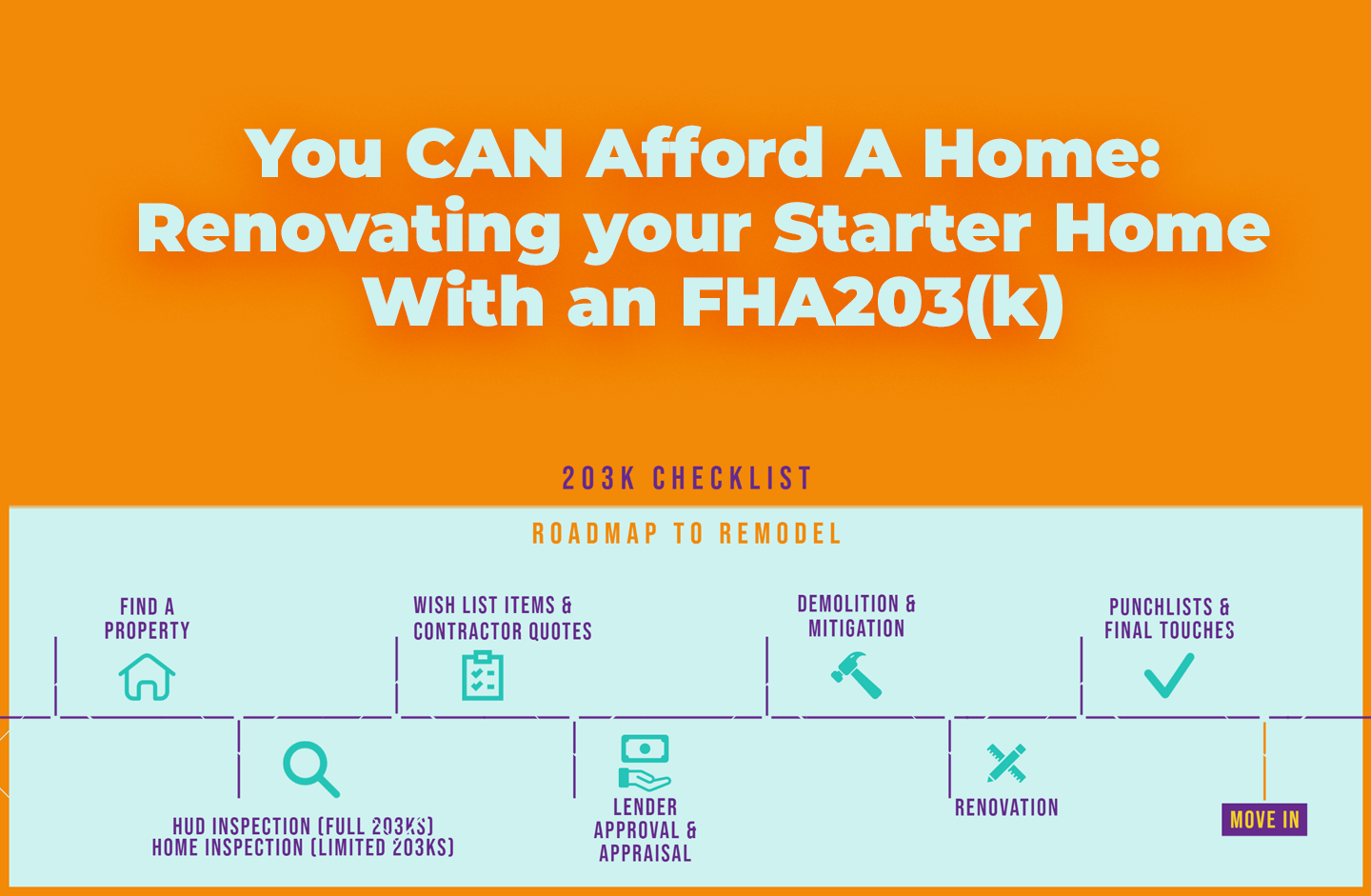

Looking to establish roots in Connecticut? The decision between buying or building a new home or renovating a starter home through an FHA 203k loan and contractor can be a daunting one. In this article, we’ll compare the two options and shed light on why homeowners are better off choosing a 203k loan when property prices are soaring. We’ll also explore the range of repairs and renovations that can be financed through a 203k loan. Read on to make an informed decision that suits your needs and budget.

The Fluctuating Real Estate Market:

1.1 The Upside of Buying a New Home:

In a seller’s market, where new home prices are high, the allure of a brand-new property can be tempting. You get a turnkey home without the hassle of renovations, ensuring peace of mind and the latest design trends.

1.2 The Advantage of FHA 203k Loans:

When new home prices skyrocket, the cost of renovating a starter home through an FHA 203k loan becomes relatively more affordable. This loan option allows you to secure a property at a lower price and invest in its transformation, potentially increasing its value.

Cost Considerations:

2.1 Lower Purchase Price with a 203k Loan:

By choosing to renovate a starter home with a 203k loan, you can save money on the initial purchase price compared to buying a new home. This can be a significant advantage when property prices are at their peak.

2.2 Financing Repairs and Renovations:

Through a 203k loan, eligible expenses for repairs and renovations can be financed, eliminating the need for additional out-of-pocket expenses. This loan program covers a wide range of improvements, from structural changes to cosmetic upgrades, giving you the flexibility to customize your home.

Repairs and Renovations Covered by a 203k Loan:

3.1 Structural Improvements:

A 203k loan can finance repairs or improvements related to the home’s structure, such as foundation repairs, roofing, plumbing, electrical work, and HVAC system upgrades. These essential upgrades ensure the safety and longevity of your home.

3.2 Cosmetic Enhancements:

Want to give your home a fresh look? A 203k loan allows you to include cosmetic improvements, such as kitchen and bathroom renovations, flooring replacements, painting, and other aesthetic enhancements. You can turn your starter home into a personalized sanctuary without breaking the bank.

3.3 Accessibility Modifications:

For homeowners with specific accessibility needs, a 203k loan covers modifications to make the home more accessible, including ramps, wider doorways, grab bars, and bathroom modifications. This enables individuals with mobility challenges to live comfortably and safely.

Expert Guidance and Contractor Selection:

4.1 Partnering with a 203k Loan Consultant:

When utilizing a 203k loan, you will work closely with a 203k loan consultant. This professional provides guidance on the loan process, helps determine eligible repairs, and ensures compliance with program guidelines. Their expertise simplifies the renovation journey.

4.2 Selecting a Qualified Contractor:

A 203k loan requires you to work with a licensed and qualified contractor. You have the opportunity to choose a contractor who understands your vision and can execute the necessary repairs and renovations. Careful selection ensures quality workmanship and a satisfactory outcome.

Conclusion:

When faced with the decision between buying a new home in Connecticut and renovating a starter home through an FHA 203k loan, it’s crucial to consider your budget, the state of the real estate market, and your personal preferences. While new homes offer convenience, the 203k loan option allows you to acquire a property at a lower cost and transform it to meet your specific needs. When property prices are soaring, the 203k loan becomes an attractive option as it provides affordability and flexibility.

Furthermore, with a 203k loan, you can finance a wide range of repairs and renovations. Structural improvements such as foundation repairs, roofing replacements, and electrical or plumbing upgrades can be covered by the loan. These essential upgrades ensure the integrity and safety of your home, providing you with peace of mind.

In addition to structural changes, cosmetic enhancements can also be included in the loan. From kitchen and bathroom remodels to flooring replacements and painting, the 203k loan allows you to give your home a fresh look without straining your budget. You have the freedom to customize your living space and create a home that reflects your personal style.

Moreover, the 203k loan program recognizes the importance of accessibility. If you or a family member requires specific modifications for mobility or disability needs, the loan can cover the costs of installing ramps, widening doorways, adding grab bars, and making bathroom modifications. These modifications ensure that everyone can enjoy a safe and comfortable living environment.

When considering a 203k loan, it is essential to work with a 203k loan consultant. This professional will guide you through the loan process, help determine eligible repairs, and ensure compliance with program guidelines. Their expertise will simplify the renovation journey and ensure a smooth experience.

Additionally, selecting a qualified contractor is crucial when using a 203k loan. A licensed and experienced contractor will understand your vision, provide accurate estimates, and deliver high-quality workmanship. Take the time to research and interview potential contractors to find the one who best aligns with your goals and budget.

In conclusion, when new home prices in Connecticut are on the rise, renovating a starter home through an FHA 203k loan and contractor becomes an appealing option. The loan provides a cost-effective solution, allowing you to purchase a property at a lower price and finance the necessary repairs and renovations. Whether you need structural improvements, cosmetic enhancements, or accessibility modifications, the 203k loan program offers flexibility and affordability. Work closely with a 203k loan consultant and select a qualified contractor to ensure a successful renovation journey. Make the most of the opportunities presented by the fluctuating real estate market and create your dream home in Connecticut with a 203k loan.