Note: This Article was updated December 4th, 2023 to reflect upcoming changes to FHA’s loan standards. See the section titled Updates in 2024.

The FHA 203k loan program has been around since the 1990s and allows homebuyers to roll the costs of renovating and repairing a home into their mortgage. With home prices and mortgage rates on the rise, some are questioning whether 203k loans are still a smart financing option in today’s housing market. In my opinion, the answer is yes – with some caveats.

Benefits of 203ks

Down payments as low as 3.5%

Avoid taking out multiple loans to buy and fix up a property.

Repairs and updates boost appraisal value

Flexible Credit Standards

Lower qualifying credit scores than conventional loans

The main benefit of a 203k loan is that it allows you to finance both the purchase and renovation of a home in one loan. This avoids having to take out and pay interest on separate loans for the home purchase and repairs. In many cases, it is the only way a buyer can afford to buy a home that needs major fixes. The program also allows for some customization of the home through renovations, rather than being limited to existing homes in move-in condition.

However, 203k loans do come with their challenges. The process is more complex than a typical mortgage, requiring more paperwork and oversight of the repairs by a HUD consultant. Borrowers must come up with their own contractor estimates and plans. The total loan amount is based on the projected costs of repairs – so accurate costs are crucial. If repairs go over budget, the borrower may need to cover the overages out of pocket.

The renovation period also means the borrower has to make mortgage payments during construction, plus unexpected costs can arise. And right now in 2023’s housing market, any financing contingencies can make offers less competitive.

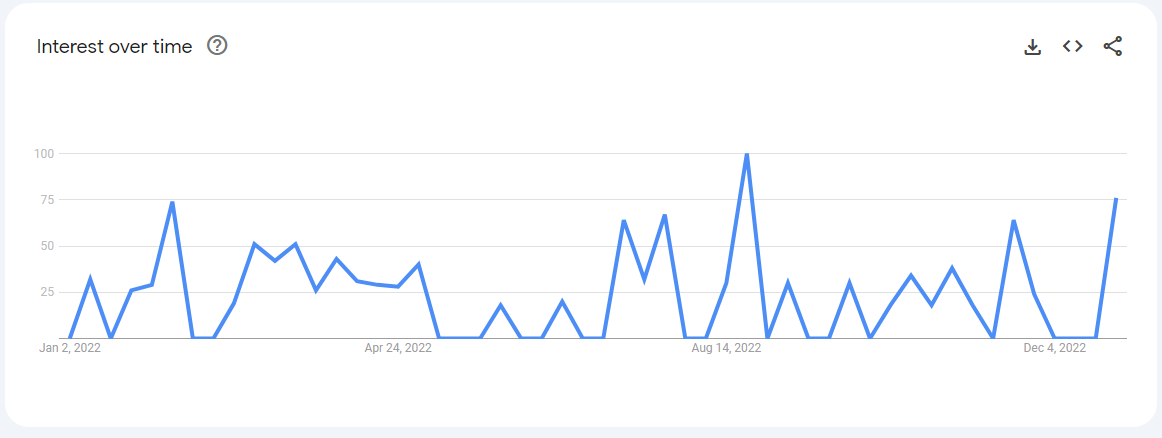

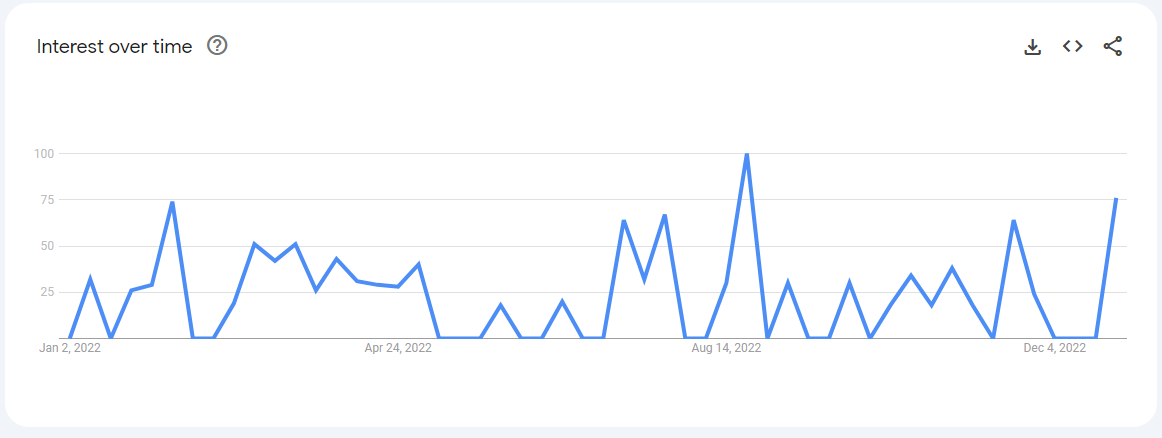

Best Time to Start a 203k

Timing is an important consideration when pursuing a 203k loan. While they can be done any time of year, the renovation period will go much smoother in the warmer spring and summer months. Contractors are generally less busy then, and weather delays are less likely to drag out the construction timeline. Starting in the fall or winter runs the risk of repairs dragging on for months longer than expected. The optimal time to begin the 203k process is likely spring, allowing renovations to wrap up before cold weather hits. However, a savvy borrower who secures contractor commitments ahead of time could potentially still pull off a winter 203k renovation. Proper planning and understanding of timelines is key no matter when you start.

FHA Changes in 2024

The FHA announced upcoming changes to FHA203k loans and standards in October, 2022, with the changes expected to take place towards the end of 2023/beginning of 2024.

Alternatives to 203ks

HomeStyle

Finance renovation costs up to 75% of the home's value.Fannie Mae HomeStyle Loan

Finance renovation costs up to 75% of the home’s value. Can be used to purchase or refinance, and modulation features let you complete repairs in phases. (Read More)

USDA

Rural properties, 0% DownUSDA Rural Development Loan

For qualifying rural properties, this zero down payment mortgage can include funds to update or repair an existing home. Credit and income limits apply. (Read More)

Home Equity Line of Credit

A home equity loan or line of credit uses your existing home equity as collateral to obtain funds for renovations. Interest rates may be higher than primary mortgages.

Personal Loans

Unsecured, varying ratesPersonal Loans

An unsecured personal loan from a bank or credit union can provide a lump sum for renovations. Amounts may be lower and interest rates higher than secured loans.

If the complexities of a 203k loan seem too daunting, there are a few alternatives to consider. One is using a home equity loan or line of credit to finance renovations on a home you already own. Personal loans from banks or credit unions are another option. And some conventional mortgages allow you to finance a certain amount of repairs into the loan amount. Talking to an experienced loan officer about the different types of renovation financing can help you find the right fit for your needs and budget. But for major overhauls needed on a home you don’t yet own, 203k loans remain one of the few products available to make large-scale renovations achievable.

Final Thoughts

So are 203k loans worth it? For the right homebuyer and property, I believe the answer is yes.

Even with its complexities, a 203k loan can absolutely be worth the effort in 2023 and beyond. Why? First, it allows buyers to purchase a home that would otherwise be unaffordable if not for the 203k financing. Second, it enables custom renovations that let homeowners make their property exactly what they want. Third, it results in potential appreciation and equity growth from the improvements made. And it does all this while still allowing low down payments and flexible credit requirements that many buyers need today. As long as you fully understand the commitment required, partner with qualified professionals, and budget carefully, a 203k mortgage can help you achieve your ownership and renovation dreams in 2023 and get you into the home you’ve always wanted.

Someone with sufficient savings, contractor expertise, and willingness to manage a complex process can end up with significant home equity and customization after renovations. But 203k loans are not for the faint of heart – make sure you understand the commitment before pursuing this financing option. Speak with a trusted lender to weigh the pros and cons for your specific situation.

FHA 203k Resources

- FHA.gov – The official site for the Federal Housing Administration has details on 203k loan requirements, processes, and FAQs.

- HUD.gov – The Department of Housing and Urban Development oversees 203k loans and has guidance for borrowers.

- 203kContractors.com – Connects borrowers with HUD-approved 203k contractors for their renovations.

- HUD 203k Calculator– Estimates total loan amounts by inputting home purchase price and expected rehab costs.

Local Resources to Look Into

- Local HUD-approved consultants – Help navigate the 203k process and oversee completion of repairs.

- Real estate agents – Experienced agents can explain pros/cons and help locate 203k-eligible properties.

- Renovation mortgage lenders – Banks like The 203k Loan Store specialize in 203k loans. Shop rates.

FAQ

Can I use a renovation loan to finance an investment property?liam_c_wp2024-02-15T15:51:41+00:00 What are the main differences between FHA203k, Homestyle, and Choice loans?liam_c_wp2024-02-15T15:50:32+00:00FHA203k, Homestyle, and Choice renovation loans differ primarily in eligibility criteria, with FHA203k being more accessible for lower credit scores and focusing on 1-4 unit residential properties requiring various renovations, including structural changes. Homestyle loans cater to a broader audience including investors, offering higher loan limits and flexibility for nearly any type of renovation, including luxury updates, across diverse property types. Choice loans are similar to Homestyle in terms of flexibility and target audience but stand out for their emphasis on financing renovations that improve disaster resilience, energy efficiency, or accessibility, providing unique advantages for specific renovation goals.

What factors should I consider when choosing between FHA 203k and Fannie Mae Homestyle loans?liam_c_wp2023-11-03T14:29:59+00:00Factors to consider include your credit score, the type and scale of your renovation, and your preferred interest rate structure.

What is the difference between the Standard and Limited 203k loans?liam_c_wp2023-11-03T14:28:30+00:00The Standard 203k is suitable for major structural repairs, while the Limited 203k is ideal for minor renovations and cosmetic improvements. Standard 203ks may require a HUD inspection, but can exceed $35,000, while limited 203ks may not require an inspection, but cannot exceed $35,000.

How can I enhance the curb appeal of my multi-family property without overspending?liam_c_wp2023-11-02T16:13:49+00:00Improving curb appeal on a budget can be achieved through landscaping, fresh paint, and small exterior updates, which typically cost between $1,000 to $5,000.

How much does it cost to renovate a kitchen in a multi-family property or rental in CT?liam_c_wp2023-11-02T16:13:02+00:00The cost of renovating a kitchen in CT can vary widely, but budget-friendly options often start at around $15,000, with more extensive upgrades averaging between $20,000 to $35,000.

Can I use an FHA 203k loan to buy a duplex in need of major repairs?liam_c_wp2023-10-27T13:33:33+00:00Yes, an FHA 203k loan allows you to purchase and renovate a duplex in need of significant repairs.

What is the average timeline for renovating a duplex with an FHA 203k loan?liam_c_wp2023-10-27T13:33:14+00:00The renovation timeline can vary, but it typically takes three to six months, depending on the extent of the renovations.

How do I renovate a rental to attract better tenants?liam_c_wp2023-10-27T13:29:07+00:00Remodeling an investment unit is a great way to attract higher-paying tenants: Current trends include open floor plans, energy-efficient features, and modern, durable finishes for both units.

What are the key differences between the Standard and Limited FHA 203k loan?liam_c_wp2023-10-27T13:26:20+00:00The Standard 203k is for major renovations, while the Limited 203k is for less extensive projects on duplex properties. A limited 203k cannot exceed $35,000 in funding, but often does not require a certified HUD inspector as a standard 203k does.

What types of renovations qualify for the FHA203(k) program?liam_c_wp2023-10-23T13:44:05+00:00Eligible renovations include structural repairs, room additions, energy efficiency upgrades, and much more. Consult your lender for a comprehensive list of qualified projects.

What are the eligibility requirements for FHA 203(k) loans?liam_c_wp2023-09-28T13:57:56+00:00To qualify for an FHA 203(k) loan, you typically need a minimum credit score, sufficient income to cover loan payments, a property in need of renovation, and compliance with FHA lending limits.

How much does it cost to get a 203(k) loan?liam_c_wp2023-09-27T18:24:53+00:00The costs are similar to a traditional mortgage – down payment, closing costs, mortgage insurance. You’ll also pay the full costs of renovations on top.

How long do 203(k) renovations take?liam_c_wp2023-09-27T18:24:32+00:00The renovation period can range from 2-6 months. Simple cosmetic renovations may take 2-3 months, while larger projects replacing structural elements take 5-6 months.

Can I get a 203(k) loan for a second home or investment property?liam_c_wp2023-09-27T18:24:01+00:00No, 203(k) loans are only eligible for primary residences you plan to live in. Second homes or investment properties do not qualify.

What credit score do you need for a 203(k) loan?liam_c_wp2023-09-27T18:22:08+00:00You can qualify for a 203(k) loan with a credit score as low as 580. However, the higher your score, the better rate you’ll likely receive. Scores of 640+ are ideal.

How Do I Find a 203k Loan Contractor?liam_c_wp2023-06-30T13:26:44+00:00Fine Home Contracting is one of Connecticut’s largest 203k contractors. For other options, we recommend checking 203kcontractors.com.

Can I use a FHA203k Renovation Loan for any type of property?liam_c_wp2023-06-30T13:24:33+00:00FHA203k Renovation Loans can be used for a variety of property types, including single-family homes, multi-unit properties (up to four units), and condominiums. However, the property must meet certain eligibility criteria, such as being the borrower’s primary residence or an investment property.

Can I use a contractor who is not familiar with 203k loans?liam_c_wp2023-06-30T13:23:50+00:00While it is possible to hire a contractor who is not familiar with 203k loans, it is advisable to work with a contractor experienced in handling such projects. Contractors who have prior experience with 203k loans understand the unique requirements and processes involved, which can help prevent delays and ensure a smoother renovation experience. Their expertise can also contribute to accurate cost estimates and adherence to FHA guidelines, reducing the risk of complications during the project. We always recommend using an FHA certified 203k specialist with good references.

What type of renovations are eligible for a 203k loan?liam_c_wp2023-06-30T13:23:50+00:00A wide range of renovations can be financed through a 203k loan. Eligible improvements include structural repairs, room additions, kitchen and bathroom remodels, energy efficiency upgrades, and accessibility modifications. However, luxury improvements that are not considered necessary for the property’s functionality, such as a swimming pool or a tennis court, are generally not eligible for financing.

How long does the renovation process typically take with a 203k loan?liam_c_wp2023-06-30T13:23:50+00:00The duration of the renovation process with a 203k loan can vary depending on the complexity of the project and the contractor’s efficiency. On average, it may take several months to complete the renovation, including the time required for planning, obtaining permits, and carrying out the construction work. Working closely with your contractor and maintaining open communication can help ensure a smooth and timely renovation process.

How do contractors get paid with a 203k loan?liam_c_wp2023-06-30T13:23:51+00:00Contractors working on a 203k loan project are paid through a specific payment process. Once the loan is approved, funds are typically held in an escrow account. The contractor submits invoices for completed work, and after verification, the lender releases funds to pay for the completed portion of the renovation. It’s crucial for contractors to keep accurate records, provide necessary documentation, and adhere to the agreed-upon payment schedule.

Are 203k contractors more expensive?liam_c_wp2023-06-30T13:23:51+00:00The cost of hiring a contractor for a 203k loan renovation can vary depending on factors such as the scope of work, location, and contractor’s rates. While it’s true that 203k contractors may charge higher fees due to their expertise in handling these specialized loans, it’s essential to consider the benefits they bring. They are experienced in navigating the complexities of 203k loans, ensuring compliance with FHA guidelines, and managing the renovation process efficiently.

Can I be my own contractor on a 203k loan?liam_c_wp2023-06-30T13:23:51+00:00Yes, it is possible to act as your own contractor on a 203k loan. However, it’s important to note that being your own contractor requires extensive knowledge of construction and project management. Additionally, you will need to meet the FHA guidelines for self-contracting, provide detailed plans and cost estimates, and assume full responsibility for the project’s successful completion.

What is a 203k Loan?finehome_2sumhq2023-05-19T16:47:37+00:00The FHA 203k loan is a renovation or construction loan, that is backed by the Federal Housing Administration. Both buyers and refinancing customers can combine the traditional “home improvement” loan with a standard FHA mortgage, which allows the homeowners to borrow their renovation costs.